TRENDS & VIEWS

Editor’s Note: Short Post Noticed By People Who Matter

Four years have zipped by and we are crossing another milestone on 31st January 2025 – it’s our 4th Anniversary. It feels good.

Looking back at the 1460 days, I must say Short Post has made its mark with people who matter via 4000 stories published in the areas of politics, business, entertainment and sports. All made possible by the unflinching commitment and dedication of our senior editors, most of whom have been part of this journey from Day One.

Small pack, big impact is in essence the story of Short Post which was launched at the height of the Covid-19 pandemic in 2021. It shows our conviction. In all humility, I can say, we have created a new niche in the news segment space like Hindustan Unilever which created a new segment, when it launched CloseUp Gel.

Yes, we have created a brand (in a limited sense), created demand (readers) and created supply (senior journalists). But we are facing teething problems like all start-ups. What makes us happy and confident is the recognition of our efforts. For instance, we have an arrangement with the OPEN Magazine, part of the $4.5 billion Kolkata-based Sanjiv Goenka-RPG Group. This arrangement sees around 10 Short Post stories posted on OPEN Magazine website every week. This arrangement is testimony that our content has been well received! Also, I may add that the Maharashtra government has recognised Short Post and has allowed our senior editor to cover the Assembly sessions. Ditto: Odisha.

Our goal is to ensure that Short Post becomes a habit. I would like people to keep checking their smartphones to know the latest Authentic Gossip. As regards AI and the fear of it disrupting all businesses including media. On that, personally, I have no such fear as I am confident AI cannot smell news particularly Authentic Gossip. That’s the place we are well entrenched.

Politics

Politics Business

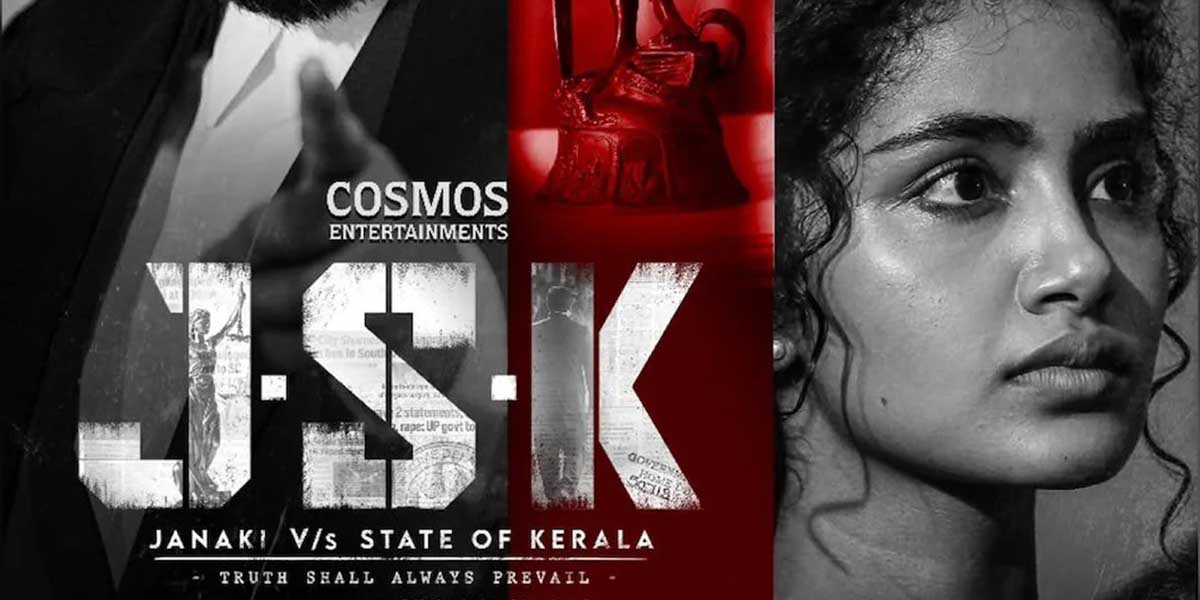

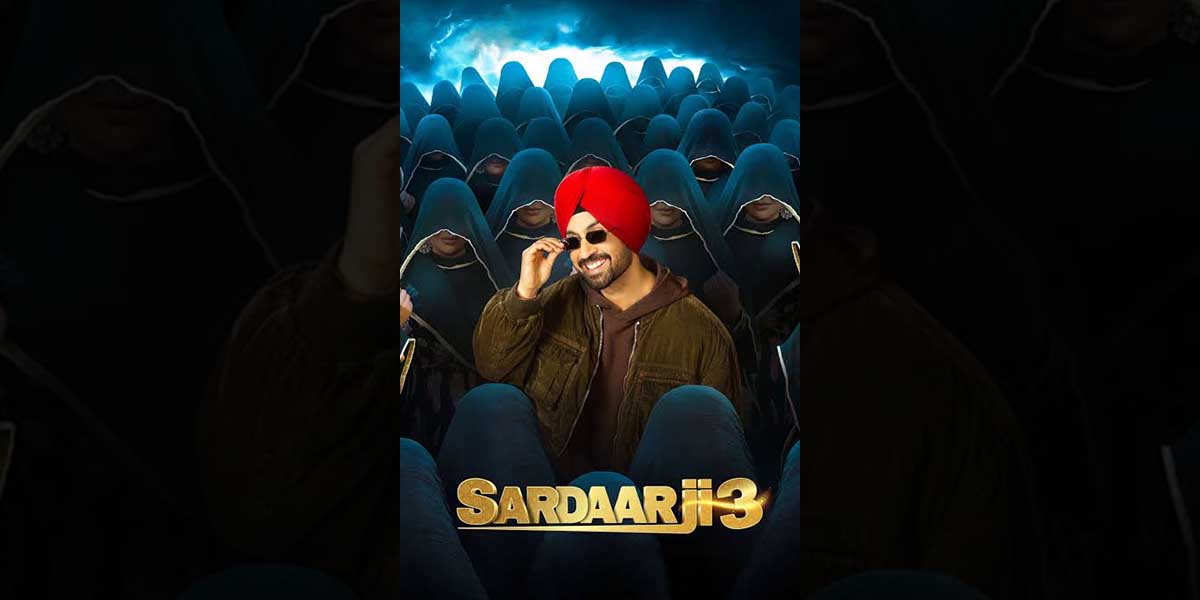

Business Entertainment

Entertainment Sports

Sports Celebrities

Celebrities