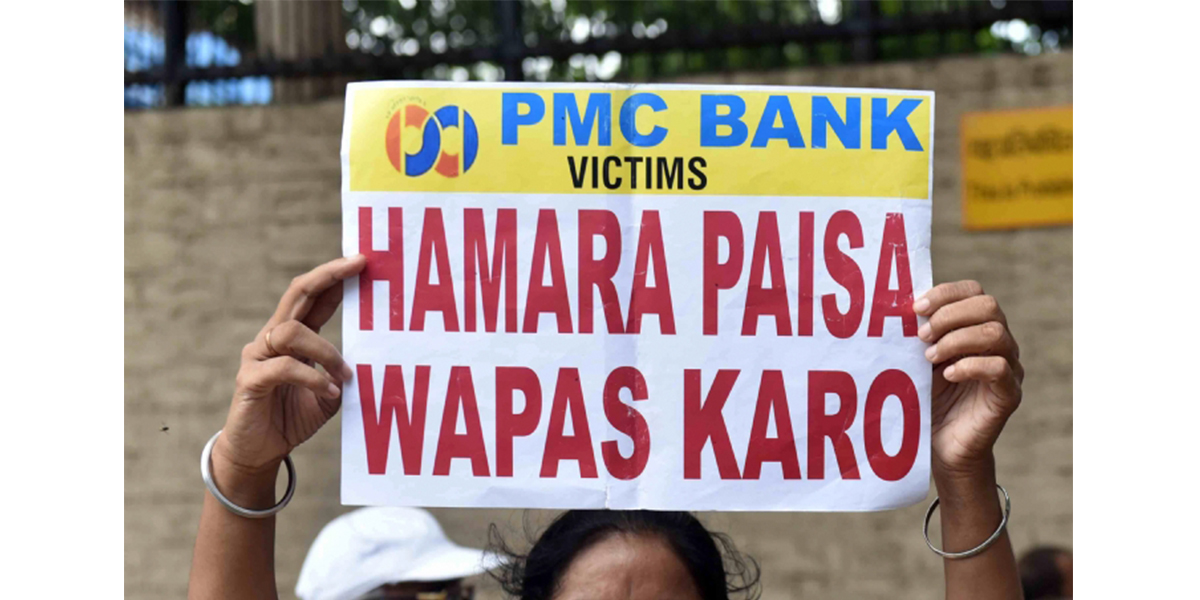

The beleaguered Punjab and Maharashtra Urban Co-operative Bank’s (PMC Bank) draft amalgamation scheme with Unity Small Finance Bank (transferee bank) may have to be reworked ahead of the upcoming BMC polls. The fly-in-the-ointment pertains to the clause that “no further interest will be payable on interest-bearing deposits of transferor (PMC) bank for a period of five years from the appointed date (of merger). It will be a long wait of five years for innocent depositors to be paid their money in full. PMC Bank’s deposits stood at Rs10,535.45 crore at end of March last year with nearly 50,000 depositors expected to bear the brunt of the current deferred payment scheme. A number of housing societies (read voters) in Mumbai had deposited their funds in the PMC Bank. Even bank employees’ cooperative credit societies were caught in this jam: The RBI Officers’ Co-operative Credit Society with some 3,500 members has FDs of Rs 105 crore while the RBI Staff & Officers Co-operative Credit Society with nearly 8,300 members has Rs 86.50 crore. Sahakar Bharati, a powerful force in the cooperatives space, has already made clear its discomfort with the scheme as things stand today and sought a relook at the repayment plan for depositors. Will political parties in the BMC polls fray take up the issue now? Last year, the RBI gave a licence to Centrum Financial Services and BharatPe to set up a small finance bank, Unity Small Finance Bank so the PMC Bank could be amalgamated with it.

Politics

Politics Business

Business Entertainment

Entertainment Sports

Sports Celebrities

Celebrities